Trading Strategies

On Alkimiya, one can take a long or short position based on one’s view on the impact of the on-chain events. Simply put, if you think an event(s) will cause significant network congestion, go long and if you think the event(s) are overhyped or the overall usage will slow down, go short.

However, trading on Alkimiya is more than that. Parameters such as entry price and size affect your orders and as a result, your PnL.

Before diving in, it’s imperative to understand the parameters/data that affect trading on Alkimiya. Make sure to check out our and Glossary for unfamiliar terms.

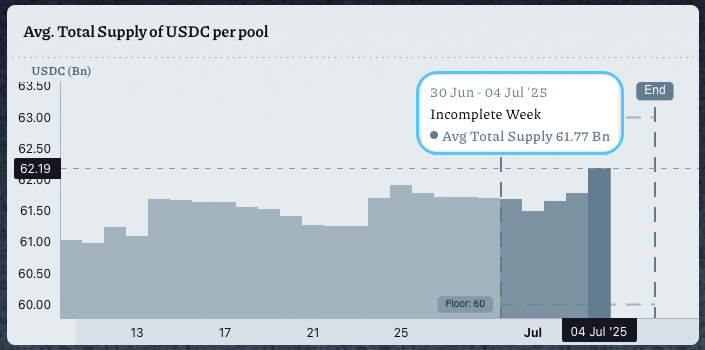

1. Check the Avg. Total Supply of USDC

Avg. Total Supply of USDCThis is the underlying index. It is the average of the USDC Total Supply across a pool’s duration and is updated daily at 3am UTC.

The settlement of this index is based on the final Avg. USDC Total Supply on the last day. In essence, when trading, keep in mind the question: “What will the Avg. USDC Total Supply be at the end of this pool?”.

Average Total Supply of USDC per Pool

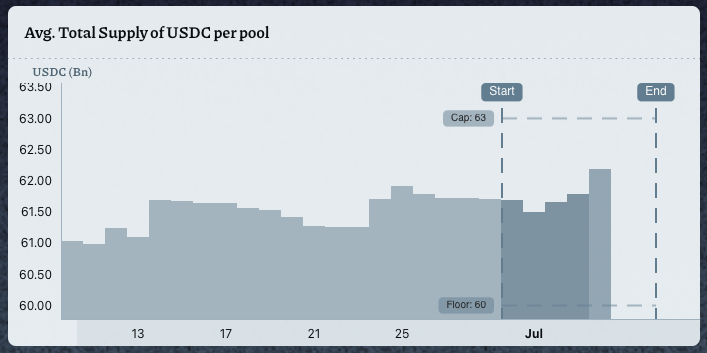

2. Check the live charts on Alkimiya

There are 2 charts:

-

Average Total Supply of USDC per Pool

- This chart displays the daily movement of USDC Supply from pool to pool

- Since this market tracks the average instead of the spot supply, it's a closer visualization of where the final

Avg. USDC Total Supplymight end up at

-

Avg. USDC Total Supply

- This chart displays the hourly, daily, and weekly movement and volatility of USDC Total Supply

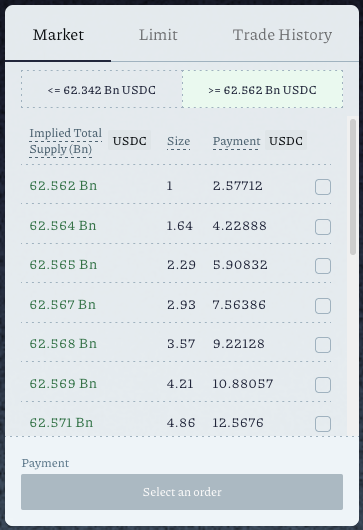

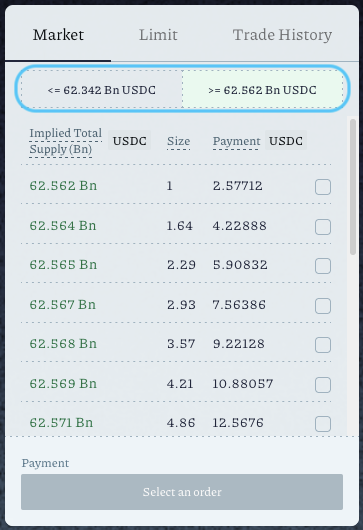

3 Check 'Market' and 'Trade History' in the orderbook

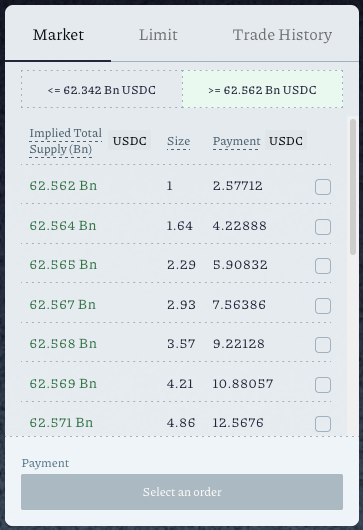

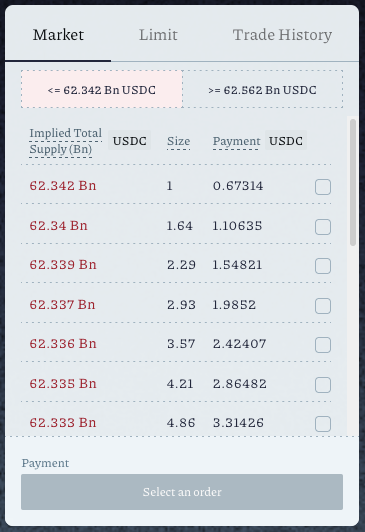

On ‘Market’, these are the available orders you can pick from within a pool. They are made by other traders on Alkimiya. Categorised as Long and Short, you can choose to fill a Long order/s or a Short order/s respectively.

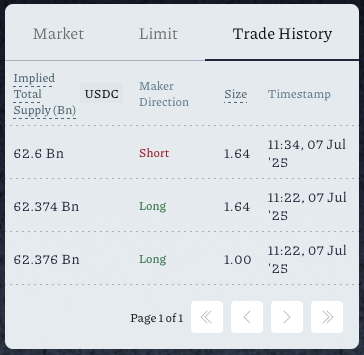

On ‘Trade History’, these are the orders that were made and filled by traders on Alkimiya.

Using these two sections, gain insight on the level of bullishness or bearishness of other traders.

Market Orders

Open Orders

Trade History

Trade History

Identifying good orders can get confusing, but it’s not impossible. Before scrutinizing the available orders, consider the decisions you’ve made prior and your risk appetite.

Resources

4. Decide on a direction you want to take

There are only 2 directions to choose from - Long or Short.

The general rule of thumb is:

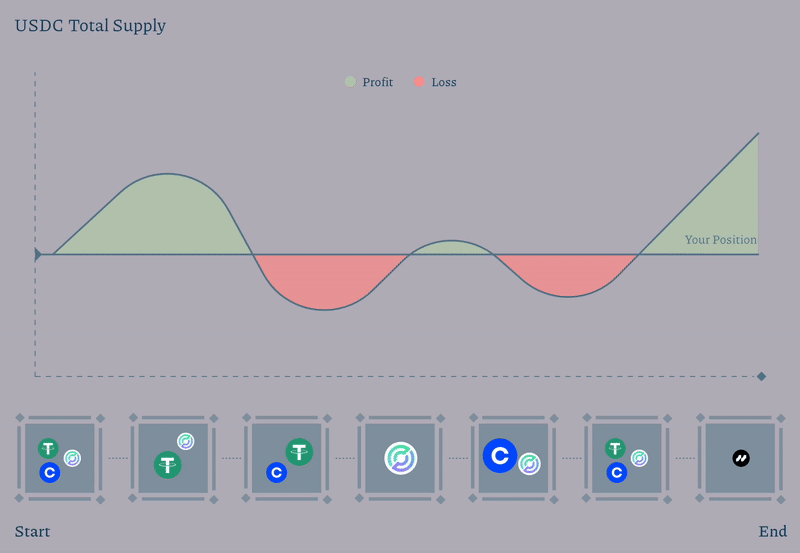

For Long orders, if the average Total Supply lands above your order’s price, you profit the difference.

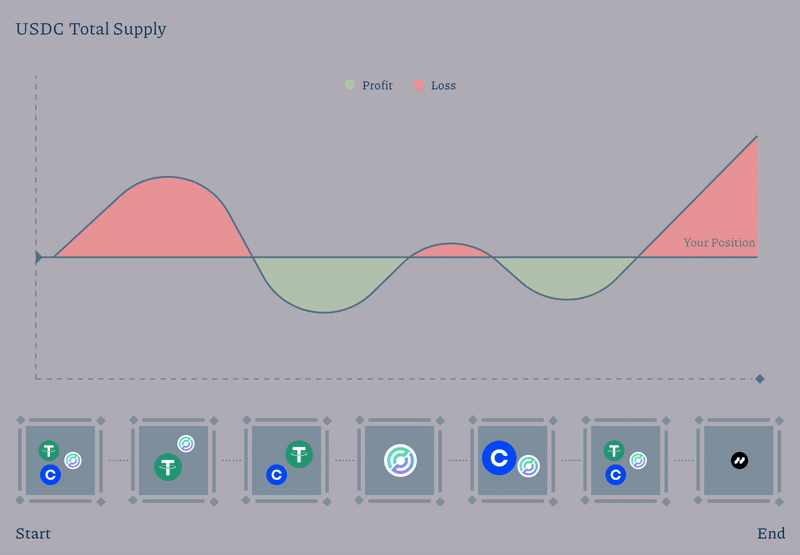

For Short orders, if the average Total Supply lands below your order’s price, you profit the difference.

Long Order PnL Visualisation

Short Order PnL Visualisation

If you've decided to Long

- Navigate to the Long orderbook and compare the available

Implied Total SupplyandAvg. Total Supply of USDC

The aim here is to:- Select an order with a lower entry price than the index

i.e.Implied Total Supply<Avg. Total Supply of USDC; or - Select an order with an entry price that is acceptable to you

i.e.Implied Total Supply< your expectedAvg. Total Supply of USDC

- Select an order with a lower entry price than the index

- Yay, you found a good order! But what is your risk appetite?

Sizeis the representation of your risk appetite. The larger the size, the riskier you want to be. However, if you have confidence in the order, go ahead and fill it!

Long Orderbook

If you've decided to Short

- Navigate to the Short orderbook and compare the available

Implied Total SupplyandAvg. Total Supply of USDC

The aim here is to:- Select an order with a higher entry price than the index

i.e.Implied Total Supply>Avg. Total Supply of USDC; or - Select an order with an entry price that is acceptable to you

i.e.Implied Total Supply> your expectedAvg. Total Supply of USDC

- Select an order with a higher entry price than the index

- Yay, you found a good order - go ahead and fill it!

Short Orderbook

6. Create your own order

If you did not manage to find a good order, you can create your own order. Here, you have full control over the Implied Total Supply, size, and expiration. However, it is not without its limitations.

Custom orders are created and placed on the orderbook for other traders to fill. If it is not filled before its expiration, the order will be removed from the book.

To ensure that the custom order gets filled before its expiration, it needs to be competitive within the orderbook.

Thus, before creating an order, it is important to get a feel of the market sentiment.

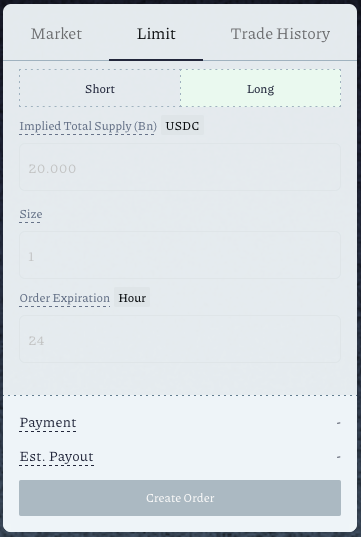

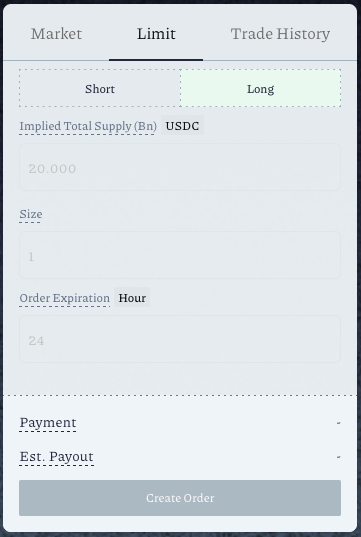

Limit Order

Implied Total Supply

The aim is to have your order at the top of the orderbook -> check the Best bid/ask

Best Bid: This is the best Short order in the orderbook

Best Ask: This is the best Long order in the orderbook

These values, when compared to Avg. Total Supply of USDC, could provide insight on how competitive your order needs to be.

Best Bid/Ask

Size

The aim is to find the perfect balance between being big enough to capture profit and being small enough to fit the general risk appetite.

Expiration

The aim is to have it available long enough for other traders to discover, and short enough so that you can make any changes to your order if needed.

Resources

If you've decided to Long

- Navigate to "Limit" and click “Long”

- Input size

Based on your risk appetite, input a value in size that best reflects that. The minimum size is 1. The larger the value, the bigger your risk appetite. - Input

Implied Total Supply

Based on your research of onchain events, input a value inImplied Total Supply. For example, the currentAvg. Total Supply of USDCis 60 Bn. You have determined that the finalAvg. Total Supply of USDCwill increase and land at 62 Bn. The best range of values to input here will be 60.1 - 61.9 Bn.

Recall that you will only profit the difference between yourImplied Total Supply and final Avg. Total Supply of USDC if the former is lower.

- Refer to

Best bid/ask

The aim here is to ensure that your order'sImplied Total Supplyis slightly higher than the Best Bid i.e. yourImplied Total Supply>Best Bid - Input

Expiration

This is the number of hours you'd like your order to remain on the orderbook. The longer the duration, the more likely your order will be seen.

Note: It is free to create your own order, but if you decide to cancel your order before the expiration, you would have to cover the cost for gas.

Create a Long Order

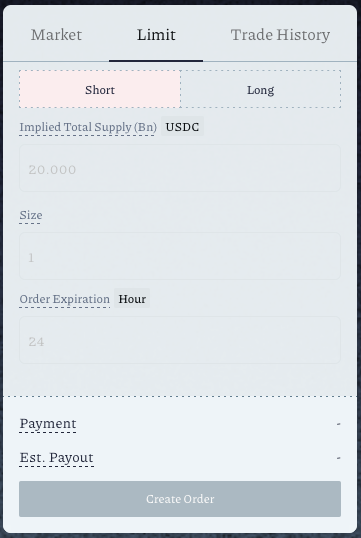

If you've decided to Short

- Navigate to "Limit" and click "Short"

- Input

size

Based on your risk appetite, input a value insizethat best reflects that. The minimum size is 1. The larger the value, the bigger your risk appetite. - Input

Implied Total Supply

Based on your research of onchain events, input a value inImplied Total Supply. For example, the currentImplied Total Supplyis 60 Bn. You have determined that the finalAvg. Total Supply of USDCwill decrease and land at 58 Bn. The best range of values to input here will be 58.1 - 59.9 Bn.

Recall that you will only profit the difference between yourImplied Total Supply and final Avg. Total Supply of USDC if the latter is lower.

- Refer to

Best bid/ask

The aim here is to ensure that your order'sImplied Total Supplyis slightly lower than theBest Aski.e. yourImplied Total Supply<Best Ask - Input

Expiration

This is the number of hours you'd like your order to remain on the orderbook. The longer the duration, the more likely your order will be seen.

Note: It is free to create your own order, but if you decide to cancel your order before the expiration, you would have to cover the cost for gas.

Create a Short Order

Voilà! Welcome to Alkimiya, Trader!

This journey is not one to be taken alone.

Updated 8 months ago